Income Reengineering Vision is one of the four parts of the Income Reengineering big picture focus

- Income Reengineering Vision

All four parts and the supporting links work together to complete the Income Reengineering Picture.

Income Reengineering Vision

Upon successful implementation of Income Reengineering Principle Part 1 and Part 2, the Income Reengineering vision will come to life. The vision states:

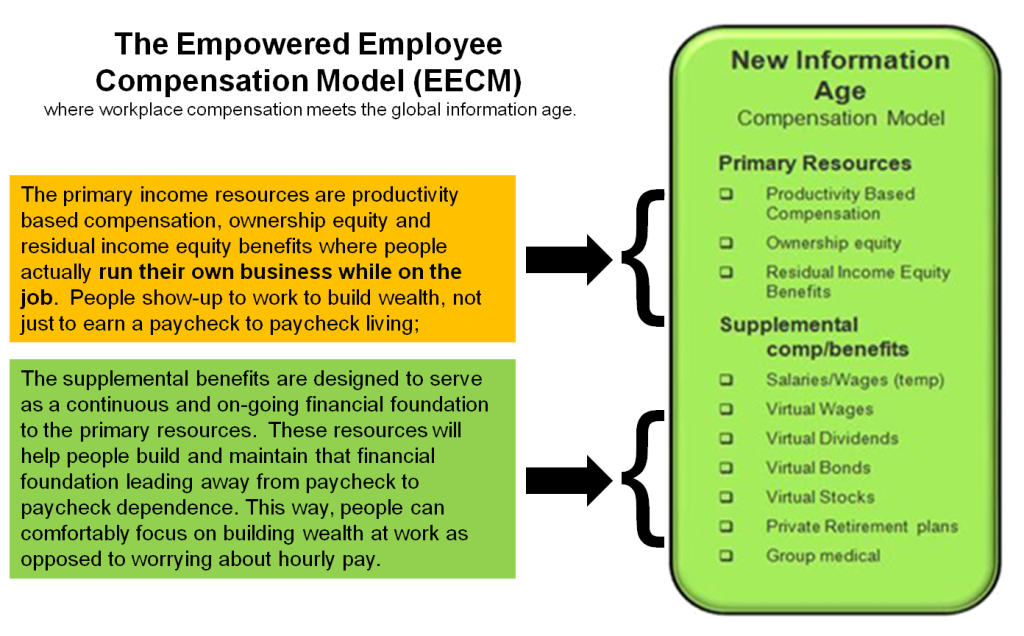

Eliminate paycheck to paycheck dependence on a large scale and shift employee thinking and focus away from just earning a paycheck to running their own business under the roof of employers with the support of employers. The resulting workplace compensation model is called the Empowered Employee Compensation Model (EECM). The EECM replaces hourly wages and salaries with ten (10) new income resources and benefits with the potential to usher in a 3-fold increase in the aggregate wealth building capacity for both employees and employers

The new workplace compensation model under this vision is called the Empowered Employee Compensation Model.

- The phrase empowered employee applies because workers are financially empowered worker-owners instead of wage dependent employees. Remember, people use the systems and resources from Part 1 and Part 2 of the Income Reengineering Principle to financially empower themselves prior to working full time under this vision.

- To this end, the model replaces hourly wages and salaries with 10 new ownership based income resources and benefits.

As you can see from the diagram of the Empowered Employee Compensation Model, the model consists of two primary parts: primary resources and supplemental benefits/resources. Now, let’s dig deeper by reviewing the primary resources.

The Primary Compensation Resources

The primary compensation resources associated with the Empowered Employee Compensation Model are:

- Productivity Based Compensation: Here, employers pay empowered employees a negotiated amount daily, weekly, monthly, or yearly linked directly to the professional services they provide to their employer. They are paid based on daily production, not a predetermined wage or salary, nor is it linked to company sales or profits. It’s hard dollars linked to what empowered employees do daily. Also, employees will not have to wait around for raises. They can give themselves a raise in real-time by merely increasing their daily productivity.

- Ownership Equity: EECM enterprises are 100% owned by original owners and workers. There are no outside investors who do not work for the EECM enterprise. Therefore all empowered employees will receive ownership shares. They can also invest in the EECM to buy more shares while they work there. However, to maintain 100% worker ownership provision, once employees leave, he/she much “cash-out” equity and invest it into their next EECM enterprise. It’s similar to selling a house and investing the proceeds into a new house.

- Residual Income Equity Benefit: This benefit pays employees a percentage of each sale made by your enterprise, whether the company makes the sale over the internet, inside the office, or over a retail counter. The company pays this regardless of whether a team member is an accountant, engineer, office manager, administrative assistant, or secretary. This benefit pays individuals while they work for your enterprise. It will then continue for some predetermined and negotiated period even after they move on to another enterprise. It’s similar to how movie actors earn income each time a re-run plays.

As you can see from the primary resources, employees effectively run their own business while on the job in collaboration with employers.

The Supplemental Compensation and Benefits

As you can see from the diagram, the supplemental compensation and benefits serve as the financial foundation for the primary resources. Here’s an outline of each resource:

- Wages/Salaries (Temp to Zero): The EECM phases out hourly wages and salaries, which is why wages/salaries are temporary to zero. It’s in the model to illustrate various transitional scenarios where employees may be learning and transitioning to the EECM primary resources;

- Virtual Wages: Virtual Wages is one of the four unique/specialized crowdfunding solutions we called the virtual income machines. Virtual wages ensure employees can get funds to pay down bills, build up savings, and generally build a financial foundation leading away to paycheck to paycheck dependence in preparation for work at an EECM enterprise. No debt-related credit checks, collateral or related issues apply. Once individuals submit a resume, interview, and get a job within an EECM enterprise, he/she can secure the funds.

- Virtual Dividends: Virtual Dividends is also one of the four unique/specialized crowdfunding solutions we called the virtual income machines. Virtual Dividends serve two primary purposes: 1) it ensures EECM enterprises can raise capital without going into debt and without violating 100% ownership provisions associated with the EECM, and 2) it ensures empowered employees will always have monthly income coming in from sources other than their primary resources. This serves as diversification of income “safety net” which add to the safety net created by virtual wages;

- Virtual Bonds: Virtual Bonds is also one of the four unique/specialized crowdfunding solutions we called the virtual income machines. Virtual Wages and Virtual Dividends are linked to the EECM. Virtual Bonds is a wealth resource accessible to individuals independent of their employer. People can use this new wealth resources to fund continuing education and skill set upgrades before showing up for work for an EECM enterprise;

- Virtual Stocks: Virtual Stocks is also one of the four unique/specialized crowdfunding solutions we called the virtual income machines. Virtual stocks ensure large companies and corporations can adequately facilitate, support, maintain, and motivate the formation of internal EECM subsidiaries without comprising 100% ownership integrity of EECM subsidiaries and without compromising the ownership value of their existing stock. In fact, because of the low overhead and productivity incentives built into the EECM, the value of stock shares associated with any company will increase significantly once that company integrates EECM subsidiaries into operations.

- Private Retirement Plans: The EECM is the antithesis to traditional workplace retirement benefits such a defined benefit plans, corporate pensions, or 401ks. Under the model, people show up for work to build wealth, not for hourly wages/salaries or corporate benefits. The model idealized complete independence from traditional corporate benefits with a 100% focus on eliminating fixed cost that’s not associated with real-time productivity and profits. To this end, empowered employees are encouraged to take control of their own retirement investment and planning — the foundation of such being the ownership equity they earn by working for an EECM enterprise via the ownership equity primary resource.

- Group Medical: Empowered employees get their Medical benefits through large entrepreneurial associations. Think about it. Empowered employees are entrepreneurs on the job. So, large national EECM entrepreneurial membership organizations will naturally form, segmented according to industries, professions, etc. These entrepreneurial organizations can quickly provide extremely affordable group medical for their association members, thereby freeing individual EECM enterprises from the expense.

As you can see, the Virtual Income Machines anchor of the supplemental compensation/Benefits. In general, Virtual Income Machines represents an evolution in crowdfunding packaging and application …all in an aggressive effort to serve as a financial foundation for the Empowered Employee Compensation Model (EECM).

For example, let’s revisit the primary question we are asking: how to apply the internet and other information technology to increase the income production and wealth-building ability of the masses at least three times over. The key phrase here is how to apply the internet and other information technology.

Now, crowdfunding is an internet-based, peer-to-peer phenomenon. With Virtual Income Machines, we are re-packaging and re-applying this internet-based phenomenon to create new wealth-building solutions for the masses.

How this vision benefits Employees, Employers, and the Nation at large

Here’s how this vision benefits employees, employers, and the nation at large. Let’s take a look starting with employees.

Benefits to Employees: Employees get the best of both worlds:

- The income, ownership, profitability, and flexibility associated with running a profitable business WITHOUT losing the financial security and guaranteed steady monthly paycheck piece of mind normally associated with a steady job.

- Financial security and the guaranteed steady monthly paycheck piece of mind comes from various applications of the Virtual Income Machines, not from hourly wages.

Employees win.

Benefits to Employers:

- Employers get a highly productive workplace (ownership motivates productivity) without having to pay the traditional payroll expense, which is typically 60% of operating expense;

- Think about it. Traditional payrolls represent a fixed expense to companies. So, whether companies make sales or make a profit any given month, they still have to meet the fixed payroll.

- More specifically, the Empowered Employee Compensation Model eliminates this fixed expense because the compensation paid to empowered employees is linked to productivity, sales, or profits. This creates significantly more cash flow flexibility for employers.

- Empowered employees can become a source of operating capital for employers with the ability to tap into resources from the virtual income machines to buy an ownership stake in the company

- Employers can use the low overhead to launch a maze of new initiatives, grow new profit centers, compete effectively in the evolving new global marketplace and, most of all, design and package new ownership-based, residual income equity and wealth oriented compensation incentives for employees;

- Employers can tap into the Virtual Income Machine resources and secure capital to restructure to an EECM compensation and operating infrastructure.

Employers win.

The Nation at Large

- Large scale deployment of the Income Reengineering Vision and the associated Empowered Employee Compensation Model equates to a 3-fold increase in the aggregate standard of living.

- This ultimately means a higher national income, a higher Gross National Production (GNP), more tax revenue for the treasury to pay down the national debt, etc..

- Today, according to statistics, 1% of the wealthy pay 40% of the taxes, and the other 99% pay the other 60%.

- If the income of the 99% increases 3 times over, then the average tax rate can drop significantly, and still, the U.S. treasury will receive enough tax revenue to pay down the national debt and then operate in a surplus continuously

The bottom line: it’s WIN-WIN at every level. Next, visit Income Reengineering Process.